We investigate the asymmetry and long memory features in the volatility of the Korean stock market. For this purpose, we examine some GARCH class models that can capture these volatility stylized factors in the KOSPI 200 Index return data. From the re...

http://chineseinput.net/에서 pinyin(병음)방식으로 중국어를 변환할 수 있습니다.

변환된 중국어를 복사하여 사용하시면 됩니다.

- 中文 을 입력하시려면 zhongwen을 입력하시고 space를누르시면됩니다.

- 北京 을 입력하시려면 beijing을 입력하시고 space를 누르시면 됩니다.

https://www.riss.kr/link?id=A104004082

- 저자

- 발행기관

- 학술지명

- 권호사항

-

발행연도

2008

-

작성언어

English

- 주제어

-

등재정보

KCI등재,SSCI,SCOPUS

-

자료형태

학술저널

- 발행기관 URL

-

수록면

383-412(30쪽)

-

KCI 피인용횟수

1

- 제공처

- 소장기관

-

0

상세조회 -

0

다운로드

부가정보

다국어 초록 (Multilingual Abstract)

We investigate the asymmetry and long memory features in the volatility of

the Korean stock market. For this purpose, we examine some GARCH class

models that can capture these volatility stylized factors in the KOSPI 200

Index return data. From the results of estimation and diagnostic tests, we

find that the decrease in volatility asymmetry in the crisis period is due to the

introduction of derivatives markets (index futures and option trading) and

the market liberalization, and that the degree of long memory features

becomes lower after the financial crisis, implying that the financial crisis has

the efficiency of the Korean stock market.

다국어 초록 (Multilingual Abstract)

We investigate the asymmetry and long memory features in the volatility of the Korean stock market. For this purpose, we examine some GARCH class models that can capture these volatility stylized factors in the KOSPI 200 Index return data. From the...

We investigate the asymmetry and long memory features in the volatility of

the Korean stock market. For this purpose, we examine some GARCH class

models that can capture these volatility stylized factors in the KOSPI 200

Index return data. From the results of estimation and diagnostic tests, we

find that the decrease in volatility asymmetry in the crisis period is due to the

introduction of derivatives markets (index futures and option trading) and

the market liberalization, and that the degree of long memory features

becomes lower after the financial crisis, implying that the financial crisis has

the efficiency of the Korean stock market.

참고문헌 (Reference)

1 Schwert, G. W., "Why Does Stock Volatility Change over Time" 44 : 1115-1153, 1989

2 Granger, C.W.J., "Varieties of Long Memory Models" 73 : 61-77, 1996

3 Breidt, F., "The detection and estimation of long memory in stochastic volatility" 83 : 325-348, 1998

4 Christie, A. A., "The Stochastic Behavior Common Stock Variances: Value, Leverage and Interest Rate Effects" 10 : 407-432, 1982

5 Byun, J. C., "The Introduction of KOSPI 200 Stock Price Index Futures and the Asymmetric Volatility in the Stock Market" 20 : 191-212, 2003

6 Ryoo, H. J., "The Impact of Stock Index Futures on the Korean Stock Market" 14 : 243-251, 2004

7 Tse, Y. K., "The Conditional Heteroscedasticity of the Yen-Dollar Exchange Rate" 13 : 49-55, 1998

8 Ghysels, E., "The Asian Financial Crisis: The Role of Derivative Securities Trading and Foreign Investor in Korea" 24 : 607-630, 2005

9 Robinson, P. M., "Testing for Strong Serial Correlation and Dynamic Conditional Heteroskedasticity in Multiple Regression" 47 : 67-84, 1991

10 Byun, J. C., "Study on Determinants of the Asymmetric Volatility in Stock Return" 16 : 31-65, 2003

1 Schwert, G. W., "Why Does Stock Volatility Change over Time" 44 : 1115-1153, 1989

2 Granger, C.W.J., "Varieties of Long Memory Models" 73 : 61-77, 1996

3 Breidt, F., "The detection and estimation of long memory in stochastic volatility" 83 : 325-348, 1998

4 Christie, A. A., "The Stochastic Behavior Common Stock Variances: Value, Leverage and Interest Rate Effects" 10 : 407-432, 1982

5 Byun, J. C., "The Introduction of KOSPI 200 Stock Price Index Futures and the Asymmetric Volatility in the Stock Market" 20 : 191-212, 2003

6 Ryoo, H. J., "The Impact of Stock Index Futures on the Korean Stock Market" 14 : 243-251, 2004

7 Tse, Y. K., "The Conditional Heteroscedasticity of the Yen-Dollar Exchange Rate" 13 : 49-55, 1998

8 Ghysels, E., "The Asian Financial Crisis: The Role of Derivative Securities Trading and Foreign Investor in Korea" 24 : 607-630, 2005

9 Robinson, P. M., "Testing for Strong Serial Correlation and Dynamic Conditional Heteroskedasticity in Multiple Regression" 47 : 67-84, 1991

10 Byun, J. C., "Study on Determinants of the Asymmetric Volatility in Stock Return" 16 : 31-65, 2003

11 Black, F., "Studies in Stock Price Volatility Changes,” in Proceedings of the 1976 Business and Economic Statistics Section" American Statistical Association 177-181, 1976

12 Kim, E. H., "Stock Markets Openings: Experience of Emerging Economies" 73 : 25-66, 2000

13 Schewrt, G. W., "Stock Market Volatility" 46 : 23-34, 1990

14 Ling, S., "Stationarity and the Existence of Moments of a Family of GARCH Processes" 106 : 109-117, 2002

15 Bollerslev, T., "Semiparametric Estimation of Long Memory Volatility Dependences: The Role of High Frequency Data’" 98 : 81-106, 2000

16 Bollerslev, T., "Quasi-maximum Likelihood Estimation of Dynamic Models with Time Varying Covariances" 11 : 143-172, 1992

17 Lamoureux, C. G., "Persistence in Variance, Structural Change, and the GARCH Model" 8 : 225-234, 1990

18 Glosten, L. R., "On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks" 48 : 1779-1801, 1993

19 Campbell, J. Y., "No News is Good News: An Asymmetric Model of Changing Volatility in Stock Returns" 31 : 231-318, 1992

20 Teyssiere, G., "Multivariate Long-memory ARCH Modelling for High Frequency Foreign Exchange Rates" 1998

21 Davidson, J., "Moment and Memory Properties of Linear Conditional Heteroscedasticity Models, and a New Model" 22 : 16-19, 2004

22 Bollerslev, T., "Modeling and Pricing Long Memory in Stock Market Volatility" 73 : 151-184, 1996

23 Engle, R. F., "Measuring and Testing the Impact of News on Volatility" 48 : 1749-1778, 1993

24 Giraitis, L., "LARCH, Leverage, and Long Memory" 2 : 177-210, 2004

25 Nelson, D. B., "Inequality Constraints in the Univariate GARCH Model" 10 : 229-235, 1992

26 Conrad, C., "Inequality Constraints in the Fractionally Integrated GARCH Model" 4 : 413-449, 2006

27 Bollerslev, T., "Generalized Autoregressive Conditional Heteroskedasticity" 31 : 307-327, 1986

28 Baillie, R. T., "Fractionally Integrated Generalized Autoregressive Conditional Heteroskedasticity" 74 : 3-30, 1996

29 Kassimatis, K., "Financial Liberalization and Stock Market Volatility in Selected Developing Countries" 12 : 389-394, 2002

30 Park, Y. C., "Fear of Floating: Korea’s Exchange Rate Policy after the Crisis" 15 : 225-251, 2001

31 French, K. R., "Expected Stock Returns and Volatility" 19 : 3-29, 1987

32 Yoon, J. I., "Empirical Studies on the Characteristics of the Volatility of the KOSPI Returns" 10 : 95-120, 2005

33 Choe, H., "Do Foreign Investors Destabilize Stock Markets The Korean Experience in 1997" 54 : 227-264, 1999

34 Andreou, E., "Detecting Multiple Breaks in Financial Market Volatility Dynamics" 17 : 579-600, 2002

35 Nelson, D. B., "Conditional Heteroskedasticity in Asset Returns: A New Approach" 59 : 347-370, 1991

36 Beine, M., "Central Bank Interventions and Jumps in Double Long Memory Models of Daily Exchange Rates" 10 : 641-660, 2003

37 Ku, B. I., "Asymmetric Volatility of the Stock Prices in Korean Stock Market" 13 : 129-159, 2000

38 Bekaert, G., "Asymmetric Volatility and Risk in Equity Markets" 13 : 1-42, 2000

39 McMillan, D. G., "Asymmetric Volatility Dynamics in High Frequency FTSE-100 Stock Index Futures" 13 : 599-607, 2003

40 Kang, S. H., "Asymmetric Long Memory Feature in the Volatility of Asian Stock Markets" 35 : 175-198, 2006

41 Chang, K. C., "An Empirical Study on the Introduction of KOSPI 200 Futures and the Asymmetric Volatility" 18 : 1307-1327, 2005

42 Kim, J., "A. Kartsaklas and M. Karanasos (2006), “The Volume-volatility Relationship and the Opening of the Korean Stock Market to Foreign Investors after the Financial Turmoil in 1997,” Working Paper, Available at http://mkaranasos.com/APFM07.pdf"

43 Oh, H. T., "A Study of Time-Varying and Asymmetric Volatility in the Korean Stock Market" 27 : 45-65, 2000

44 Ding, Z., "A Long Memory Property of Stock Returns and a New Model" 1 : 83-106, 1993

동일학술지(권/호) 다른 논문

-

Economic Growth and Technology Diffusion in Developing Countries

- 한국경제학회

- ( Ji Uk Kim )

- 2008

- KCI등재,SSCI,SCOPUS

-

- 한국경제학회

- ( Moon Sung Kang )

- 2008

- KCI등재,SSCI,SCOPUS

-

Asymmetry and Long Memory Features in Volatility: Evidence From Korean Stock Market

- 한국경제학회

- ( Sang Hoon Kang )

- 2008

- KCI등재,SSCI,SCOPUS

-

- 한국경제학회

- ( Hong Gue Lee )

- 2008

- KCI등재,SSCI,SCOPUS

분석정보

인용정보 인용지수 설명보기

학술지 이력

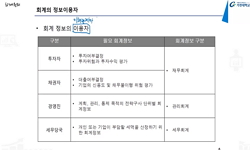

| 연월일 | 이력구분 | 이력상세 | 등재구분 |

|---|---|---|---|

| 2023 | 평가예정 | 해외DB학술지평가 신청대상 (해외등재 학술지 평가) | |

| 2020-01-01 | 평가 | 등재학술지 유지 (해외등재 학술지 평가) |  |

| 2010-01-01 | 평가 | 등재학술지 유지 (등재유지) |  |

| 2008-01-01 | 평가 | 등재학술지 유지 (등재유지) |  |

| 2006-01-01 | 평가 | 등재학술지 유지 (등재유지) |  |

| 2004-01-01 | 평가 | 등재 1차 FAIL (등재유지) |  |

| 2001-07-01 | 평가 | 등재학술지 선정 (등재후보2차) |  |

| 1999-01-01 | 평가 | 등재후보학술지 선정 (신규평가) |  |

학술지 인용정보

| 기준연도 | WOS-KCI 통합IF(2년) | KCIF(2년) | KCIF(3년) |

|---|---|---|---|

| 2016 | 0.45 | 0.39 | 0.37 |

| KCIF(4년) | KCIF(5년) | 중심성지수(3년) | 즉시성지수 |

| 0.32 | 0.28 | 0.868 | 0 |

KCI

KCI